Power of Attorney Online

Obtain a Power of Attorney easily from home with B-Legal. Exceptional value starting from just £200 ensuring affordability for all.

Don't delay creating your

Power of Attorney

At B-Legal, we're passionate about making Power of Attorney easy and affordable for everyone. With our friendly service, you can secure your document from just £200 - no surprises, just simple and cost-effective support for your peace of mind.

How to get your Lasting Power of Attorney

Provide personal info.

Kindly provide the names, addresses, and birthdates of your chosen attorneys for the documentation.

Expert review

After our specialists review your papers, they'll be dispatched without delay.

Sign and date

Just add your signature and the date, and they're ready for registration.

Post to register

After registration, your ready-to-use document will be returned to you.

For assistance anytime, just ring us at 0808 1 750490

Lasting Power of Attorney explained

What is a Lasting Power of Attorney?

A Lasting Power of Attorney (LPA) is an official form that allows you (the 'donor') to nominate individuals ('attorneys') to manage your affairs or decide for you if you can't.

It ensures your affairs are in trusted hands if you're ever incapacitated due to illness or injury.

Health & Welfare LPA

A Health and Welfare Lasting Power of Attorney enables your chosen attorney to oversee aspects such as:

Personal care routines like bathing, clothing, and dietary choices

Healthcare provisions

Residential and care home arrangements

Decisions regarding life-preserving procedures

This authority activates only if you're no longer able to make decisions for yourself.

Property & Finance LPA

A Property and Financial Affairs Lasting Power of Attorney authorizes your attorney to handle your financial matters, such as:

Overseeing bank and building society transactions

Handling bill payments

Administering benefit or pension collections

Facilitating the sale of your property

This LPA can be utilized immediately after registration, provided you have given consent.

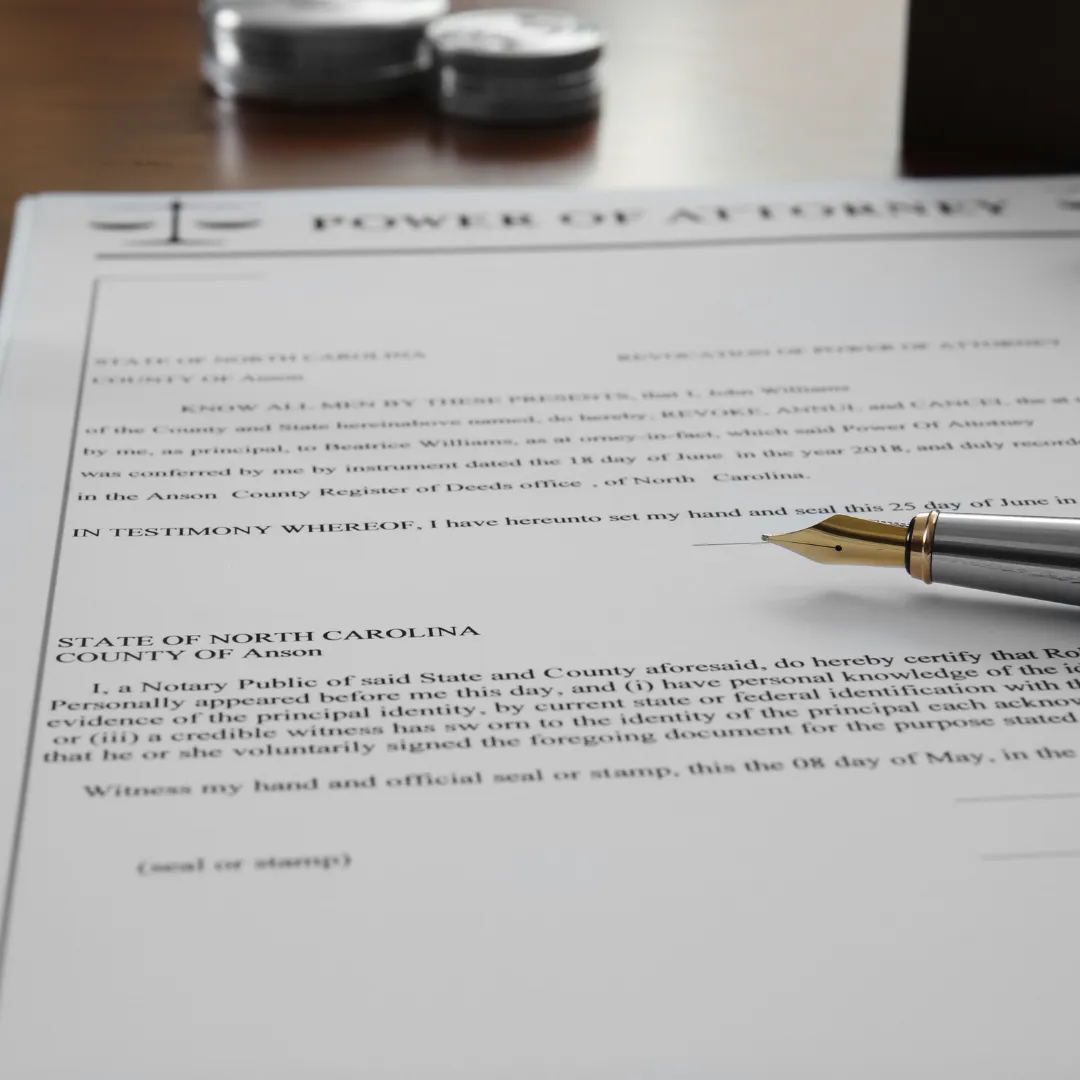

Signing your Lasting Power of Attorney

Signing and dating your documents is straightforward—just adhere to the given instructions for correct execution. After signing, your documents are prepared for registration.

At B-Legal, we ensure the documents are marked distinctly, guiding you to sign accurately and confidently.

Registering your documents

The Office of the Public Guardian (OPG) applies a registration fee ranging from £0 to £82 for each Lasting Power of Attorney.

This fee isn't covered in our pricing.

Our service will inform you about the applicable registration fees. You'll pay these fees directly to the OPG once registration commences. You have the choice to pay via card or cheque; if you opt for card payment, the OPG will reach out to you for the payment at the appropriate time.

There's no set deadline for registering your documents after completion, but remember they only become legally effective once registered.

Needing a helping hand?

Our team of experts is here to assist you at each stage of the process.

Our services

Wills with Trusts

Wills with Trusts combines estate planning methods, enabling specific asset distribution, potential tax benefits, and controlled support for beneficiaries after the testator's demise.

Lifetime Trusts

Lifetime Trusts, established during the settlor's lifetime in the UK, offer strategic estate management, asset protection, and tailored beneficiary provisions for future financial security.

Lasting Power of Attorney

Lasting Power of Attorney (LPA) in the UK enables individuals to appoint trusted persons to manage their health, welfare, or financial affairs in potential future incapacity scenarios.

Prefer a Home Visit ? Book a home visit

Prefer a face-to-face discussion about your estate planning? B-Legal offers the convenience and comfort of home visits. Our trusted associates are ready to meet you in your own home, ensuring a personalized and private experience.

During the visit, they will provide detailed guidance on wills, powers of attorney, and trusts, tailored to your unique circumstances. Schedule your home visit today and embark on your estate planning journey with the utmost confidence and ease.

Clients Feedback

Explore Your Options: Online, Zoom, or Home Appointments - We Have a Service to Suit Every Budget

Navigating the complexities of Power of Attorney is made easy with B-Legal's comprehensive services. Whether you prefer the convenience of online, Zoom, or home appointments, we have a solution that fits your needs and budget.

Experience the simplicity of establishing a Power of Attorney online with B-Legal. Our platform connects you with accredited legal advisors who specialize in Power of Attorney arrangements, ensuring a secure and streamlined process.

Whether you're planning for future healthcare decisions, financial management, or safeguarding your assets, our digital solutions are designed for clarity and ease of use. B-Legal's commitment to accessible and trustworthy online legal services transforms how you prepare for tomorrow.

Protect your autonomy and ensure your wishes are honored with B-Legal's expertly guided online Power of Attorney services. Trusted by clients nationwide, B-Legal stands as a beacon of innovation in online estate planning.

Discover why our clients recommend B-Legal for seamless, professional online Power of Attorney services.

Insights and Advice

Downsizing Your Home for Estate Planning: A Wise Move?

Is it Wise to Downsize? An In-Depth Look at Home Downsizing for Tax Purposes

Downsizing, the act of moving into a smaller, more manageable property, is often considered a practical decision for those approaching retirement or looking to simplify their lifestyle. However, when it comes to estate planning, the implications of downsizing extend beyond just lifestyle changes; it can significantly impact one’s inheritance tax obligations.

The Financial Appeal of Downsizing

Inheritance Tax Benefits: One of the primary incentives for downsizing is the potential reduction in inheritance tax liability. A smaller home generally means a lower estate value, which can be crucial if your current property's value pushes your estate above the £325,000 inheritance tax threshold.

Increased Cash Flow: Selling a larger property and moving into a smaller one can release significant equity. This liquidity can be redirected into savings, investments, or even as gifts to family members, which can also play a part in reducing your future inheritance tax liabilities.

The Emotional and Practical Side

Sentimental Value: The family home is often more than just property; it's a treasure trove of memories. Leaving this behind can be emotionally challenging and is a significant factor to consider.

Lifestyle Adjustments: Downsizing often means adjusting to a smaller space, which might affect your lifestyle. This could include having less room for hosting family gatherings or pursuing hobbies that require space.

The Costs of Moving: The financial benefits of downsizing can be offset by the costs associated with moving, such as estate agent and legal fees, and the physical act of moving itself.

Estate Planning Considerations

Professional Advice: It's essential to consult with estate planning experts, like b-legal.co.uk, who can provide comprehensive advice considering your overall financial and estate planning strategy.

Long-Term Planning: Downsizing should be viewed as a component of a broader estate planning strategy, rather than a standalone solution. Other elements like wills, trusts, and lifetime gifting should also be considered to create a balanced and effective estate plan.

Conclusion

Downsizing can be a smart move for estate planning, but it's not without its challenges. The decision should be well-thought-out, considering both financial benefits and personal implications. Professional advice is key to ensure that this step aligns with your broader estate planning goals.

Frequently Asked Questions

1. What is a Lasting Power of Attorney (LPA)?

An LPA is a legal document allowing one person (the attorney) to make decisions on behalf of another (the donor). It's used when the donor either no longer wishes or is unable to make decisions due to a lack of mental capacity. The LPA specifies the type of decisions the attorney can make and under what circumstances.

2. What are the types of LPAs?

There are two types:

Health and Welfare LPA: Effective when the donor loses mental capacity. Decisions include living arrangements, medical treatments, diet, contact with others, and activities.

Property and Financial LPA: Can be effective before or after the donor loses mental capacity. Decisions include managing finances, property transactions, and investments.

3. How do I register a Power of Attorney?

Registration involves choosing an attorney, getting signatures from a certificate provider and attorneys, notifying people (optional), submitting forms to the Office of the Public Guardian (OPG), and waiting for OPG registration, which can take 8-10 weeks.

4. What are the fees for registering a Power of Attorney with the OPG?

The fee is £82 per document, paid directly to the Office of Public guardian. Exemptions or reductions are available based on income and financial circumstances.

5. When should I start acting as an attorney?

You should begin acting as an attorney once the LPA is registered with the OPG. For health and welfare LPAs, you act when the donor loses capacity. For property and financial LPAs, you can act before or after the donor loses capacity, based on their preference.

6. What duties does an attorney have?

Duties include acting in the donor’s best interests, applying a duty of care, following instructions, helping the donor make decisions, maintaining confidentiality, and for property and financial affairs, keeping accounts and financial separation.

7. What does it mean to ‘act in the best interests’ of the donor?

Acting in the best interests involves considering the donor’s wishes, beliefs, values, and circumstances, avoiding assumptions, and respecting the views of those close to the donor.

8. Can a donor appoint more than one attorney?

Yes, donors can appoint joint attorneys (who must act together) or joint and several attorneys (who can act independently or together).

9. What if I disagree with another attorney’s decision?

If you disagree with a co-attorney, try to resolve it directly. If unresolved, you may contact the OPG with evidence.

10. How do I know if someone lacks mental capacity?

Assume an adult can make their own decisions unless proven otherwise. A reasonable belief of lack of capacity should be based on the inability to understand, remember, weigh up, or communicate decisions. Professional assessments may be necessary in complex situations.

We simplify the process of creating

a will or granting power of attorney.

B Legal operate as a company registered in England & Wales Privacy Policy Terms & Conditions

Our registered office is Bankwood Lane, Rossington, Doncaster, England, DN11 0PS