Power of Attorney Online

Obtain a Power of Attorney easily from home with B-Legal. Exceptional value starting from just £200 ensuring affordability for all.

Don't delay creating your

Power of Attorney

At B-Legal, we're passionate about making Power of Attorney easy and affordable for everyone. With our friendly service, you can secure your document from just £200 - no surprises, just simple and cost-effective support for your peace of mind.

How to get your Lasting Power of Attorney

Provide personal info.

Kindly provide the names, addresses, and birthdates of your chosen attorneys for the documentation.

Expert review

After our specialists review your papers, they'll be dispatched without delay.

Sign and date

Just add your signature and the date, and they're ready for registration.

Post to register

After registration, your ready-to-use document will be returned to you.

For assistance anytime, just ring us at 0808 1 750490

Lasting Power of Attorney explained

What is a Lasting Power of Attorney?

A Lasting Power of Attorney (LPA) is an official form that allows you (the 'donor') to nominate individuals ('attorneys') to manage your affairs or decide for you if you can't.

It ensures your affairs are in trusted hands if you're ever incapacitated due to illness or injury.

Health & Welfare LPA

A Health and Welfare Lasting Power of Attorney enables your chosen attorney to oversee aspects such as:

Personal care routines like bathing, clothing, and dietary choices

Healthcare provisions

Residential and care home arrangements

Decisions regarding life-preserving procedures

This authority activates only if you're no longer able to make decisions for yourself.

Property & Finance LPA

A Property and Financial Affairs Lasting Power of Attorney authorizes your attorney to handle your financial matters, such as:

Overseeing bank and building society transactions

Handling bill payments

Administering benefit or pension collections

Facilitating the sale of your property

This LPA can be utilized immediately after registration, provided you have given consent.

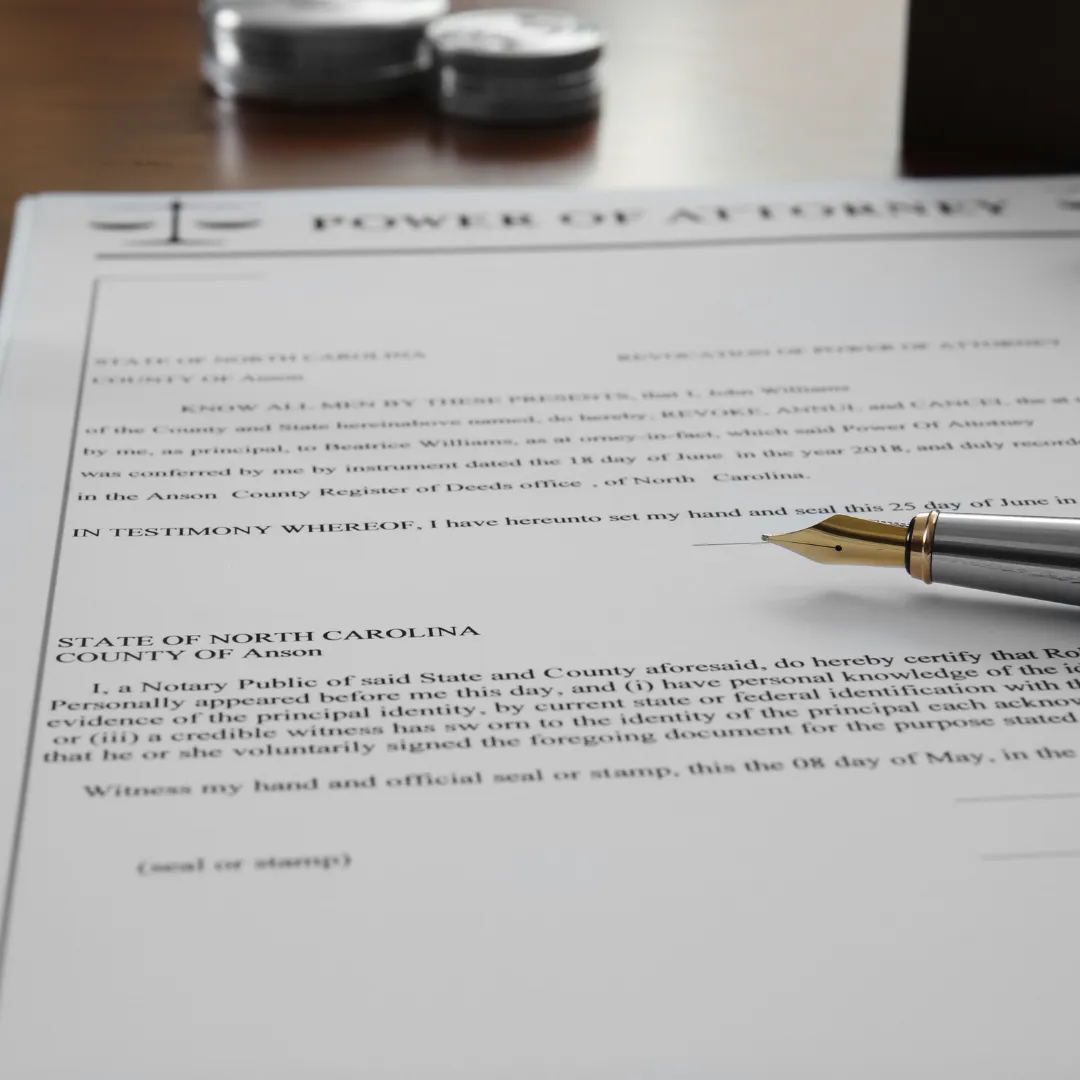

Signing your Lasting Power of Attorney

Signing and dating your documents is straightforward—just adhere to the given instructions for correct execution. After signing, your documents are prepared for registration.

At B-Legal, we ensure the documents are marked distinctly, guiding you to sign accurately and confidently.

Registering your documents

The Office of the Public Guardian (OPG) applies a registration fee ranging from £0 to £82 for each Lasting Power of Attorney.

This fee isn't covered in our pricing.

Our service will inform you about the applicable registration fees. You'll pay these fees directly to the OPG once registration commences. You have the choice to pay via card or cheque; if you opt for card payment, the OPG will reach out to you for the payment at the appropriate time.

There's no set deadline for registering your documents after completion, but remember they only become legally effective once registered.

Needing a helping hand?

Our team of experts is here to assist you at each stage of the process.

Our services

Wills with Trusts

Wills with Trusts combines estate planning methods, enabling specific asset distribution, potential tax benefits, and controlled support for beneficiaries after the testator's demise.

Lifetime Trusts

Lifetime Trusts, established during the settlor's lifetime in the UK, offer strategic estate management, asset protection, and tailored beneficiary provisions for future financial security.

Lasting Power of Attorney

Lasting Power of Attorney (LPA) in the UK enables individuals to appoint trusted persons to manage their health, welfare, or financial affairs in potential future incapacity scenarios.

Prefer a Home Visit ? Book a home visit

Prefer a face-to-face discussion about your estate planning? B-Legal offers the convenience and comfort of home visits. Our trusted associates are ready to meet you in your own home, ensuring a personalized and private experience.

During the visit, they will provide detailed guidance on wills, powers of attorney, and trusts, tailored to your unique circumstances. Schedule your home visit today and embark on your estate planning journey with the utmost confidence and ease.

Clients Feedback

Explore Your Options: Online, Zoom, or Home Appointments - We Have a Service to Suit Every Budget

Navigating the complexities of Power of Attorney is made easy with B-Legal's comprehensive services. Whether you prefer the convenience of online, Zoom, or home appointments, we have a solution that fits your needs and budget.

Experience the simplicity of establishing a Power of Attorney online with B-Legal. Our platform connects you with accredited legal advisors who specialize in Power of Attorney arrangements, ensuring a secure and streamlined process.

Whether you're planning for future healthcare decisions, financial management, or safeguarding your assets, our digital solutions are designed for clarity and ease of use. B-Legal's commitment to accessible and trustworthy online legal services transforms how you prepare for tomorrow.

Protect your autonomy and ensure your wishes are honored with B-Legal's expertly guided online Power of Attorney services. Trusted by clients nationwide, B-Legal stands as a beacon of innovation in online estate planning.

Discover why our clients recommend B-Legal for seamless, professional online Power of Attorney services.

Insights and Advice

Retirement Planning in the Shadow of Coal:

Retirement Planning in the Shadow of Coal:

Introduction:

Once the backbone of the UK's industrial power, coal mining regions have undergone significant transformation since the peak of the industry in the 1970s and 80s. Today, the brave souls who powered the nation, now in their golden years, face the complex task of estate planning in a post-coal era. This blog aims to guide former miners and their families through safeguarding their legacies, with a special focus on protecting homes from inheritance tax through the strategic use of trusts.

Close-up image of coal chunks symbolizing the legacy of coal mining communities and the importance of tailored retirement and estate planning for their residents.

South Wales Valleys

The South Wales Valleys are synonymous with coal mining in the UK. At the industry's zenith, these valleys were lined with pits, and the communities here thrived on coal. Towns like Merthyr Tydfil and Rhondda became bustling centers of production, drawing workers from across the nation. The decline of coal mining hit hard, leading to significant social and economic shifts. Today, the valleys are navigating a post-industrial landscape, with efforts focused on revitalizing the local economy and preserving the rich cultural heritage of the mining era.

North East England

North East England, particularly Durham and Northumberland, was a powerhouse of coal production, playing a pivotal role in fueling the Industrial Revolution. The region's mines were known for their depth and the quality of coal extracted. The legacy of mining here is profound, with communities still deeply connected to their mining roots. Initiatives in these areas now aim to honor this history through heritage projects and support the transition towards new industries.

Yorkshire

Yorkshire's coalfields, especially in West and South Yorkshire, were among the most productive in the UK. Towns like Barnsley and Doncaster became synonymous with coal mining, with generations of families working in the mines. The closure of the pits left a lasting impact, but it also led to a strong sense of solidarity and community resilience. Efforts to diversify the economy have seen growth in sectors like technology and renewable energy, yet the pride in the region's mining heritage remains.

Scotland

The Central Belt and Fife in Scotland were once at the heart of the country's coal production. Mines like those at Lanarkshire and the Lothians were critical to both local economies and the national energy supply. Following the industry's decline, these areas have faced challenges in economic regeneration and environmental restoration. However, there's a strong push towards innovation and sustainability, with former mining lands being repurposed for new commercial and green spaces.

Nottinghamshire and Derbyshire

The East Midlands, particularly Nottinghamshire and Derbyshire, played a crucial role in the UK coal mining story. The discovery of extensive coal seams led to the development of large mining communities in these counties. Today, as these areas transition away from their coal-dependent past, there's a focus on leveraging their strategic location and skilled workforce to attract new business and investment, while also commemorating the mining heritage that shaped them.

Reflecting on the Transition

Each of these regions shares a common thread: a rich history intertwined with the coal mining industry and a journey towards renewal and adaptation in the post-coal era. The transition has not been without its challenges, but it has also opened avenues for regeneration and innovation. As these communities look forward, the legacy of mining continues to play a significant role in shaping their identities and aspirations, making the protection of legacies through estate planning all the more pertinent for the individuals and families who call these areas home.

Types of Trusts

Life Interest Trusts: These trusts allow you to grant someone (often a spouse or partner) the right to benefit from your assets during their lifetime. Upon their death, the assets can then pass to another specified beneficiary. This arrangement can be particularly useful in ensuring that a partner can continue to live in the family home, while ultimately preserving the value of the property for children or other beneficiaries.

Discretionary Trusts: Offering the utmost flexibility, discretionary trusts allow trustees (whom you appoint) to make decisions about how to use the trust income, and sometimes the capital, for the benefit of the beneficiaries. This type of trust is beneficial for protecting assets for future generations while accommodating changing circumstances, such as the evolving needs of beneficiaries or fluctuating financial situations.

Bare Trusts: Simplicity defines bare trusts, where assets are held in the name of a trustee but the beneficiary has the right to all the capital and income of the trust at any age. These are straightforward and often used to pass assets to young people, becoming fully accessible to them as adults.

Benefits of Using Trusts

Asset Protection and Control: Trusts can safeguard assets from potential future risks, such as business liabilities or divorce settlements, ensuring that wealth is preserved for intended beneficiaries. They offer a strategic way to control when and how beneficiaries receive their inheritance, which can be crucial for managing young or financially inexperienced heirs.

Mitigating Inheritance Tax: Properly structured trusts can help reduce the inheritance tax liability, potentially saving substantial amounts for your beneficiaries. By placing assets within a trust, they may not count towards your estate for inheritance tax purposes, depending on the type of trust and when it was established.

Flexibility and Peace of Mind: Trusts can be tailored to the specific needs and circumstances of your family, offering flexibility that other estate planning tools may not. They provide peace of mind, knowing that your assets are managed according to your wishes and that your loved ones are taken care of.

Other Estate Planning Considerations

Wills: A will is fundamental to any estate plan, ensuring your assets are distributed according to your wishes. Without a will, your estate may be divided according to standard legal formulas, which might not reflect your intentions or the needs of your beneficiaries.

Lasting Powers of Attorney (LPA): An LPA allows you to appoint someone you trust to make decisions on your behalf if you're no longer able to do so yourself. There are two types: one for financial decisions and another for health and welfare, both critical for comprehensive estate planning.

Professional Advice: Given the complexities surrounding trusts, wills, and LPAs, as well as the specific challenges and opportunities in former coal mining regions, seeking professional advice is essential. An expert can help tailor your estate plan to your unique situation, ensuring that your assets are protected, and your family’s future is secure.

In summary, estate planning in the context of the UK's former coal mining communities involves a thoughtful combination of trusts, wills, and powers of attorney. Each plays a vital role in safeguarding the financial security and legacy of those who have spent their lives in these storied regions, helping them navigate the transition from a coal-powered past to a hopeful future.

Expanding on how trusts can be utilized to mitigate inheritance tax (IHT) liabilities for former miners and their families involves a closer examination of the mechanics behind IHT, the strategic use of trusts, and illustrative examples that bring these concepts to life.

Inheritance Tax Thresholds and Rates

Inheritance Tax in the UK is charged on estates valued over a certain threshold, which currently stands at £325,000 (known as the "nil-rate band"). Anything above this amount is potentially taxed at 40%. However, there's an additional threshold for homeowners, the "residence nil-rate band," offering an extra allowance when passing on a main residence to direct descendants, which can further reduce the inheritance tax liability.

For former miners, whose estates may include the family home as a significant asset, understanding how these thresholds apply is crucial in planning to reduce or eliminate potential IHT.

Trust Strategies to Protect Your Home

Placing a Property into a Trust: One effective strategy is to place the family home into a trust. This can be done in several ways, depending on the desired outcome:

- A Life Interest Trust for the family home allows a spouse or partner to live in the property for life, after which it passes to other named beneficiaries (e.g., children). This approach can help in utilizing the residence nil-rate band while ensuring the property eventually goes to the next generation.

- A Discretionary Trust may be used where there's a desire to provide for a broader group of beneficiaries (such as children and grandchildren), with trustees having the discretion to decide how the property is used to benefit them.

These strategies can help ensure that the value of the home is effectively managed within the estate, potentially reducing the IHT exposure by making full use of available allowances and exemptions.

Case Studies: Hypothetical Examples

Case Study 1: John, a retired miner from the Yorkshire coalfields, owns a home valued at £400,000. Concerned about IHT, he places the property in a Life Interest Trust for his wife, Mary, with their children as eventual beneficiaries. This arrangement allows Mary to remain in the home, and on her passing, the property goes directly to their children, making use of both the nil-rate band and residence nil-rate band effectively.

Case Study 2: Sarah, whose parents worked in the South Wales Valleys mines, inherited a family home. She decides to place this property into a Discretionary Trust, aiming to benefit her children and grandchildren. The trust's flexibility allows for the property's value to be considered outside of her estate for IHT purposes, with the trustees managing the property according to the family's evolving needs.

Conclusion

The role of trusts in estate planning, particularly in the context of inheritance tax and protecting the family home, underscores the importance of tailored advice. For those in former mining communities, the legacy of a lifetime's work—including the family home—can be safeguarded for future generations with careful planning.

Professionals like B-Legal specialize in navigating the nuances of estate planning, ensuring that strategies like trusts are implemented effectively to meet the unique needs and circumstances of each family. By seeking expert guidance, former miners and their families can ensure that their legacies are preserved, honoring the hard work and resilience that characterized their contributions to the UK's coal mining heritage.

This comprehensive approach to inheritance tax and trusts aims to provide valuable insights and practical strategies for former miners and their families, guiding them through the complexities of estate planning with clarity and confidence.

Frequently Asked Questions

1. What is a Lasting Power of Attorney (LPA)?

An LPA is a legal document allowing one person (the attorney) to make decisions on behalf of another (the donor). It's used when the donor either no longer wishes or is unable to make decisions due to a lack of mental capacity. The LPA specifies the type of decisions the attorney can make and under what circumstances.

2. What are the types of LPAs?

There are two types:

Health and Welfare LPA: Effective when the donor loses mental capacity. Decisions include living arrangements, medical treatments, diet, contact with others, and activities.

Property and Financial LPA: Can be effective before or after the donor loses mental capacity. Decisions include managing finances, property transactions, and investments.

3. How do I register a Power of Attorney?

Registration involves choosing an attorney, getting signatures from a certificate provider and attorneys, notifying people (optional), submitting forms to the Office of the Public Guardian (OPG), and waiting for OPG registration, which can take 8-10 weeks.

4. What are the fees for registering a Power of Attorney with the OPG?

The fee is £82 per document, paid directly to the Office of Public guardian. Exemptions or reductions are available based on income and financial circumstances.

5. When should I start acting as an attorney?

You should begin acting as an attorney once the LPA is registered with the OPG. For health and welfare LPAs, you act when the donor loses capacity. For property and financial LPAs, you can act before or after the donor loses capacity, based on their preference.

6. What duties does an attorney have?

Duties include acting in the donor’s best interests, applying a duty of care, following instructions, helping the donor make decisions, maintaining confidentiality, and for property and financial affairs, keeping accounts and financial separation.

7. What does it mean to ‘act in the best interests’ of the donor?

Acting in the best interests involves considering the donor’s wishes, beliefs, values, and circumstances, avoiding assumptions, and respecting the views of those close to the donor.

8. Can a donor appoint more than one attorney?

Yes, donors can appoint joint attorneys (who must act together) or joint and several attorneys (who can act independently or together).

9. What if I disagree with another attorney’s decision?

If you disagree with a co-attorney, try to resolve it directly. If unresolved, you may contact the OPG with evidence.

10. How do I know if someone lacks mental capacity?

Assume an adult can make their own decisions unless proven otherwise. A reasonable belief of lack of capacity should be based on the inability to understand, remember, weigh up, or communicate decisions. Professional assessments may be necessary in complex situations.

We simplify the process of creating

a will or granting power of attorney.

B Legal operate as a company registered in England & Wales Privacy Policy Terms & Conditions

Our registered office is Bankwood Lane, Rossington, Doncaster, England, DN11 0PS